Disruptive New Technologies

June 30, 2022

By Ryan M. Thomas

There are a number of books in my library that I have read and re-read with a certain regularity because of their timeless wisdom. One such book is The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. The author, Clayton Christensen, summarizes the dilemma by explaining how incremental innovation by successful firms is overcome by disruptive new technologies.

In Christiansen’s book, he explains that firms do not have a short or medium term economic incentive to disrupt their own products – especially profitable products -, but instead are incentivized to pursue incremental innovation to improve performance, reduce production time or cut costs which in turn maximize profits. Disruption, on the other hand, is a threat to innovative companies that do not anticipate new technologies that threaten from below, or put more simply, that emerge initially as lower margin products. The superior performance of the new technology may equate to lower margins that the legacy company is not able to compete with because of higher cost structures. Failure to adapt to a disruptive new technology in a timely manner can result in the demise of a great legacy company.

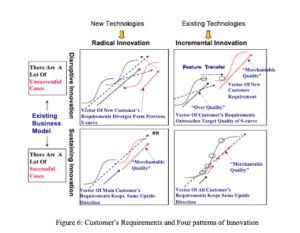

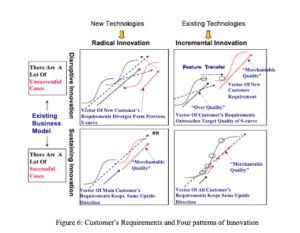

Christiansen explains that the Disruptive Technology S Curve essentially leapfrogs previous technologies creating significantly greater efficiencies, dramatically reducing manufacturing time, or radically improving efficacy – in some cases all 3 align for a truly disruptive and superior product or service.

This disruption is especially difficult for great legacy companies to overcome because over time they naturally gravitate towards high end and higher margin products or services. This disruptive new product comes up from below in a segment that they are seemingly moving away from, but with time and market adoption, this disruptive new technology eventually moves into the market that the great legacy company had been profiting from and upends or disrupts their business model.

If the great legacy company sees and anticipates this disruptive technology, there may still be time to partner or acquire the new company and preserve their position as a great legacy company, but in some cases the technology is underestimated or leadership is asleep at the wheel. With their inability to quickly pivot away from their expensive cost structure serving the higher end market, their flank is exposed and they fail to protect against entrants coming up from below.

The start-up, or early stage company, has the distinct advantage of building not only a new platform to learn and improve upon the limitations of existing platforms, but also to build a culture that serves the new mission, reinforcing the values necessary to invent disruptive, novel technologies.

The main challenge for the new company is not necessarily the development of the disruptive technology, but the identification of an emerging market that is ready for adoption. Once the emerging market is secured, the disruptive technology has a chance to prove itself and plot a path towards expansion into the mainstream market.

This creative disruption has littered the corporate graveyard with companies like Blockbuster, Polaroid, Kodak, Toys R Us, and even General Motors who once had dominated their respective markets.

In biotech, disruption is a constant threat to BigPharma and an opportunity for biotech startups. With the recent volatility in the capital markets, investors have expressed concern about BigPharma’s ability to smartly deploy their cash reserves internally. Some underperforming divisions are being sold off, or spun off, and acquisitions of new technologies are beginning to gain more traction. While biotech valuations have taken a hit over the last year, many of the largest firms are fundamentally sound with very large cash positions ready to be deployed to backfill their vaccine or therapeutic pipelines.

Eyam’s Disruptive Technologies

Eyam’s research and development is focused not on incremental improvements of existing products, but rather on novel, disruptive new technologies to radically reduce cost structures, significantly improve vaccine design, increase payload delivery, and maximize long-lasting efficacy.

Disruptive New Technologies

June 30, 2022

By Ryan M. Thomas

There are a number of books in my library that I have read and re-read with a certain regularity because of their timeless wisdom. One such book is The Innovator’s Dilemma: When New Technologies Cause Great Firms to Fail. The author, Clayton Christensen, summarizes the dilemma by explaining how incremental innovation by successful firms is overcome by disruptive new technologies.

In Christiansen’s book, he explains that firms do not have a short or medium term economic incentive to disrupt their own products – especially profitable products -, but instead are incentivized to pursue incremental innovation to improve performance, reduce production time or cut costs which in turn maximize profits. Disruption, on the other hand, is a threat to innovative companies that do not anticipate new technologies that threaten from below, or put more simply, that emerge initially as lower margin products. The superior performance of the new technology may equate to lower margins that the legacy company is not able to compete with because of higher cost structures. Failure to adapt to a disruptive new technology in a timely manner can result in the demise of a great legacy company.

Christiansen explains that the Disruptive Technology S Curve essentially leapfrogs previous technologies creating significantly greater efficiencies, dramatically reducing manufacturing time, or radically improving efficacy – in some cases all 3 align for a truly disruptive and superior product or service.

This disruption is especially difficult for great legacy companies to overcome because over time they naturally gravitate towards high end and higher margin products or services. This disruptive new product comes up from below in a segment that they are seemingly moving away from, but with time and market adoption, this disruptive new technology eventually moves into the market that the great legacy company had been profiting from and upends or disrupts their business model.

If the great legacy company sees and anticipates this disruptive technology, there may still be time to partner or acquire the new company and preserve their position as a great legacy company, but in some cases the technology is underestimated or leadership is asleep at the wheel. With their inability to quickly pivot away from their expensive cost structure serving the higher end market, their flank is exposed and they fail to protect against entrants coming up from below.

The start-up, or early stage company, has the distinct advantage of building not only a new platform to learn and improve upon the limitations of existing platforms, but also to build a culture that serves the new mission, reinforcing the values necessary to invent disruptive, novel technologies.

The main challenge for the new company is not necessarily the development of the disruptive technology, but the identification of an emerging market that is ready for adoption. Once the emerging market is secured, the disruptive technology has a chance to prove itself and plot a path towards expansion into the mainstream market.

This creative disruption has littered the corporate graveyard with companies like Blockbuster, Polaroid, Kodak, Toys R Us, and even General Motors who once had dominated their respective markets.

In biotech, disruption is a constant threat to BigPharma and an opportunity for biotech startups. With the recent volatility in the capital markets, investors have expressed concern about BigPharma’s ability to smartly deploy their cash reserves internally. Some underperforming divisions are being sold off, or spun off, and acquisitions of new technologies are beginning to gain more traction. While biotech valuations have taken a hit over the last year, many of the largest firms are fundamentally sound with very large cash positions ready to be deployed to backfill their vaccine or therapeutic pipelines.

Eyam’s Disruptive Technologies

Eyam’s research and development is focused not on incremental improvements of existing products, but rather on novel, disruptive new technologies to radically reduce cost structures, significantly improve vaccine design, increase payload delivery, and maximize long-lasting efficacy.